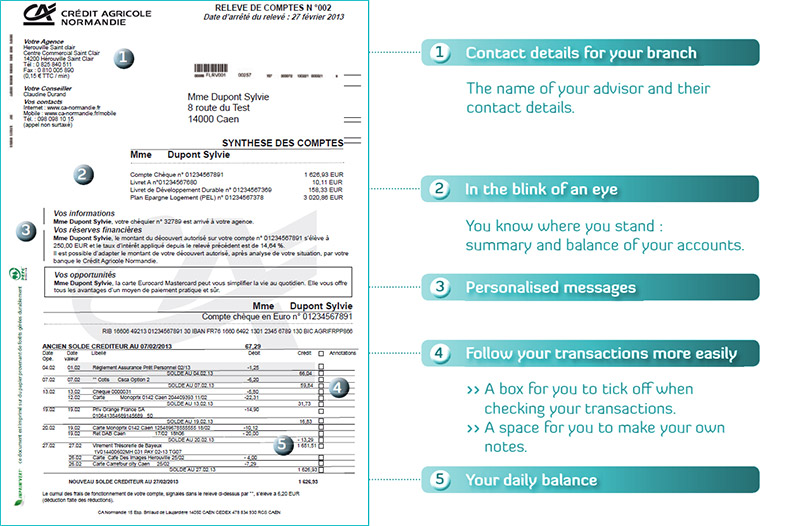

Understanding your bank statement

Simpler, pratical and easier to understand

Discover the new look and the new practical features on your bank statement. Ensuring your satisfaction is important to us. Our services are evolving to adapt to your needs. We thank you for your confidence and loyalty.

Receive your statements in differents ways : For example : Electronic statements or depending on your situation you can request to receive all of the households bank statements in the same envelope. Other possibilities also available; ask your advisor for further details.