Paying with cheques

A cheque book can be issued when opening your account or at any time after it is opened. Cheques are still regularly used for payments throughout France and are considered like cash, with no cheque guarantee cards. The limit of a cheque is the balance of your account! For this reason there are strict regulations in place, and if you are using your chequebook to make a payment you may be asked to provide a proof of your identity. A cheque can only be written if there are funds available and can only be cancelled if lost or stolen.

Good to know: You cannot post-date a French cheque.

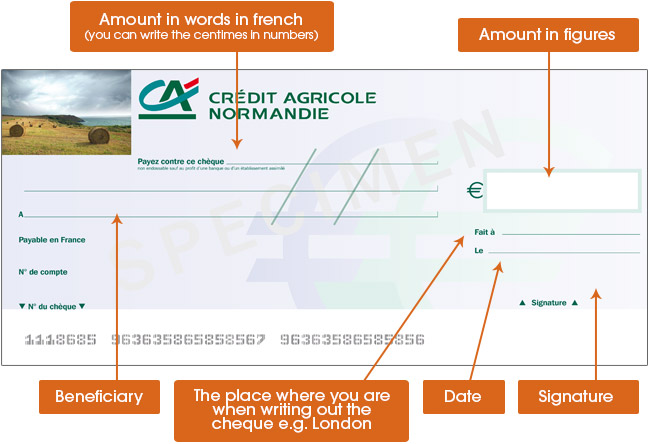

Here is a quick guide on how to fill in a French cheque

Tips:

- It is illegal in France to write a cheque for an amount exceeding the balance of your account.

- Avoid postdating cheques, as once they have been issued they could be presented immediately.

- Validity of a cheque is 12 months and 8 days.

- Please make sure the beneficiary of the cheque has signed the reverse of the cheque and written his account number on the reverse also, before sending to us. This is to avoid any delays upon crediting the cheque to your account.