Welcome to Britline French Banking, British thinking

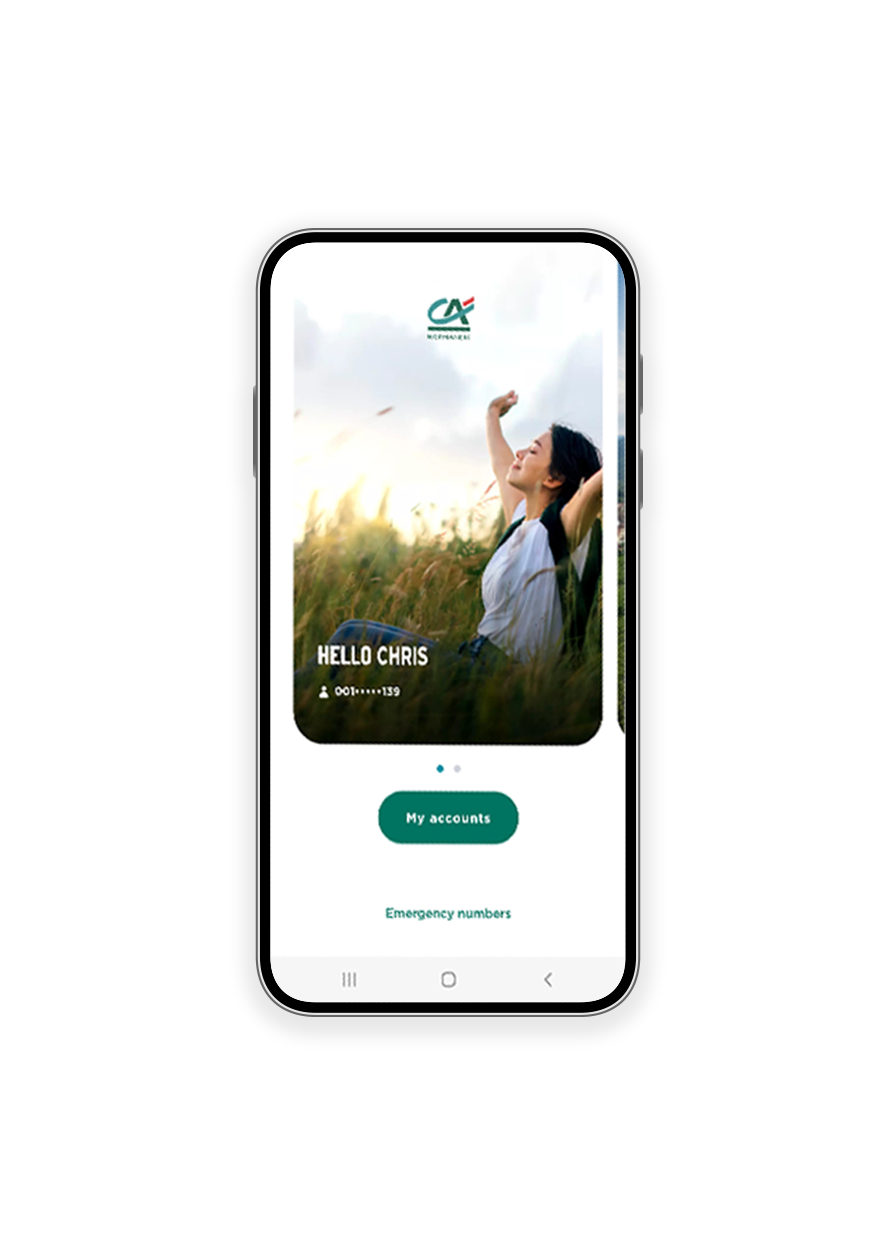

Banking app in English

With our "Ma Banque" app, you can spend, save and manage your money, all in one place.

What do you want to do in France?

Live and work

Starting a new chapter in France

Own a Holiday home

Giving you the best of both worlds

Retire

Offering you a different pace of life

Semi-retire

Taking a more relaxed way of life

What our customers say about us...

Mary

Thank you very much indeed for a swift and entirely satisfactory response, which is very much appreciated. It is such a delight when someone does exactly what you hoped they might, with no debate or delay.

Tony

Thank you also for such great customer service always. I wonder if you pass on my note of appreciation of your assistance on many occasions to your senior colleagues.

Daniel

I have not been with your bank for long , however I’ve obviously chosen banks well! Every occasion I have contact with you, it’s a pleasure, everything is dealt with quickly and I can only give praise to you all.

Gordon

Can I thank you and the bank for all the help and assistance over the last months while we sort our finances. Take care and many thanks it has been really appreciated.

Sophie

Thank you as always. Exceptional service.

Patrice

Wonderful – thank you. Once again a prompt and efficient service. I’m really greatful.

On the go banking in English

Manage your finances easily and safely with our Ma Banque banking app in English.

We are part of the largest bank in France.

Our bilingual team of French and English speakers will help you with all of your financial requirements in France.

Wherever you want to be in France our online account is made for you.